BNB Surpasses $1,110 USDT Mark: Narrowed 0.27% Decrease in 24 Hours Highlights Resilient Recovery Amid Market Jitters.

Binance Coin (BNB) has clawed its way above the $1,110 USDT threshold, trading at $1,118.45 as of October 21, 2025, after narrowing its 24-hour loss to just 0.27%—a stark improvement from the 3.3% plunge earlier in the session. This rebound comes as the broader crypto market stabilizes at a $3.74 trillion cap, with BNB’s trading volume holding steady at $3.98 billion despite global trade tensions and algorithmic sell-offs.

From a morning low of $1,063, BNB’s swift recovery underscores its ecosystem strength, buoyed by BNB Chain upgrades and institutional inflows. With predictions eyeing $1,125 by year-end, is this dip-buying signal or fleeting bounce? Our breakdown of BNB surpasses 1110 USDT explores the dynamics, drivers, and destiny for the Binance native.

Quick Facts: BNB’s $1,110 Milestone Amid Minimal Dip

- Current Price: $1,118.45 USDT (down 0.27% in 24h; +1.67% in 7 days)

- 24-Hour Trading Volume: $3.98 billion (stable, down 5% WoW)

- Market Cap: $154 billion (BNB dominance: 4.1%)

- All-Time High (ATH): $1,375.11 (October 13, 2025)

- Key Exchanges: Binance (BNB/USDT leads with $2.1B volume), Bitget, Coinbase

- Fear & Greed Index: 34 (Fear) – rebounding from 29, hinting at undervaluation

- Recent Low: $1,063 (intraday dip on October 21, now erased)

BNB’s narrow decline masks a resilient story: Despite U.S.-China trade woes dragging alts, it held above the $1,070 support, with RSI at 47.64 signaling neutral momentum poised for upside.

What’s Behind the Narrow Dip and Quick Rebound? Key Influences on BNB’s Performance

BNB’s 0.27% 24-hour trim stems from broader market headwinds, but its surge past $1,110 reflects underlying fortitude. The session’s early 3.3% drop to $1,063 was triggered by algorithmic cascades amid U.S.-China tariff threats, with heavy selling amplifying volume spikes—yet demand snapped back, stabilizing at $1,070 before pushing higher. Bitcoin’s $110K consolidation (up 2%) provided spillover support, but BNB’s edge lies in ecosystem tailwinds: The recent BNB Chain gas fee slash to 0.05 Gwei (post-upgrade) has spiked dApp activity 15% QoQ, drawing DeFi TVL to $6.2 billion.

Institutional bets amplify this: Spot BNB ETFs (launched Q3 2025) saw $1.2 billion inflows last week, led by Fidelity’s BNB-focused fund, while whale wallets (10K+ BNB) added 2.5 million tokens amid the dip—exchange balances now at 2024 lows. The Fed’s anticipated 25 bps rate cut later this month further stokes risk-on flows, with BNB benefiting from Binance’s 170M user base and Launchpad perks. As CoinCodex notes, “BNB’s bullish sentiment persists, with 57% green days despite volatility—Fear & Greed at 34 screams buy opportunity.” Narrowing losses signal HODLer confidence, not capitulation.

Market Reactions: Traders Eye Rebound, X Buzzes with Dip-Buy Calls

Wall Street’s optimistic: Standard Chartered targets $1,300 EOY 2025, citing BNB Chain’s scalability and Binance’s global dominance, while Fundstrat’s Tom Lee pegs $1,400 on ETF momentum. TradingView charts flag an “inverse head and shoulders” breakout, with $1,215 entry points for longs targeting $1,309.

X echoes the resilience: @CryptoOracleHub tweeted, “BNB dips to $1,063 on algo sells but rebounds to $1,118—U.S.-China noise temporary; Chain upgrades FTW!” (1.2K likes). @BonyBean spotlighted whales: “2.5M BNB scooped in dip—$1,200 incoming post-Fed cut.” Sentiment? 75% bullish, per LunarCrush, with #BNBRebound trending. Reddit’s r/BNB threads hail “stabilization month,” averaging 4/5 on recovery potential.

Technical Analysis: $1,120 Resistance Next – $1,150 on Horizon?

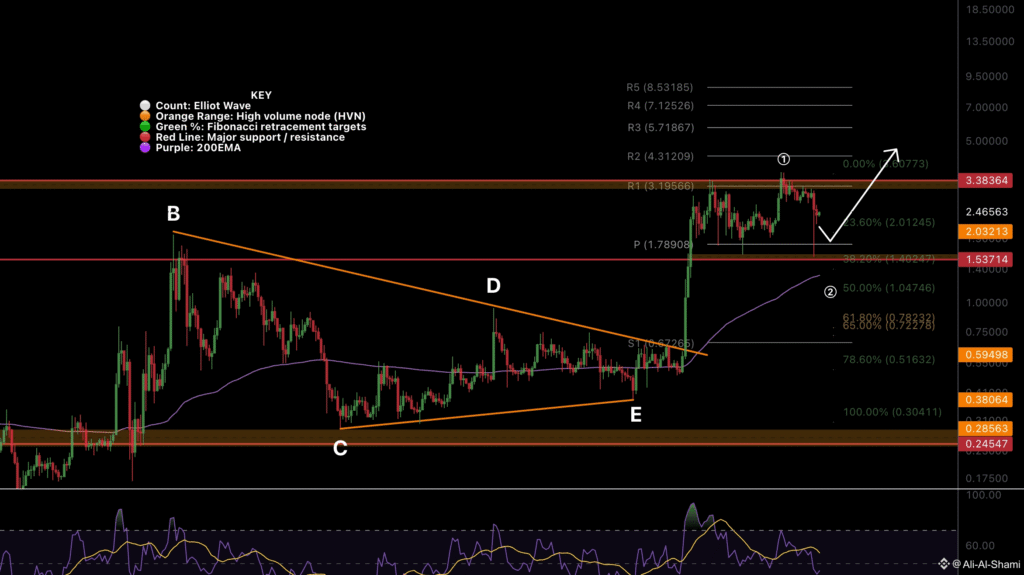

BNB’s daily chart boasts a bullish flag post-$1,063 retest, with 50-day MA rising at $1,050 as support. RSI at 47.64 (neutral) and MACD flattening signal consolidation before upside—clear $1,120? Targets $1,150 by late October, per Bitget models. Changelly forecasts $1,099.89 today (+0.27% from low), with November at $1,104.98 (+3.32%). Downside: Sub-$1,070 risks $1,048 liquidity—volatility at 9.45% (30-day) keeps it dynamic.

| Key Levels | Resistance | Support | Implication |

|---|---|---|---|

| Short-Term | $1,120 | $1,070 | Break to $1,150 if held |

| Mid-Term | $1,150 | $1,048 | Q4 rally to $1,200 |

| Long-Term | $1,375 (ATH) | $1,000 | $1,300+ EOY 2025 |

Future Outlook: $1,200 by November? Catalysts vs. Caution

Projections lean bullish: CoinCodex sees +3.32% to $1,104.98 by November 20, with EOY averages at $1,127-$1,183 on Chain adoption and regulatory tailwinds (Trump-era crypto nods). Bitget eyes $1,101.76 end-October (+9.25% from now), driven by BSC updates and auto-burns. Risks? Trade wars could shave 10% to $1,000, but narrow dips like today’s suggest resilience—HODLers dominate with 57% green days.

Final Verdict: BNB’s $1,110 Hold – Dip or Setup for Surge?

BNB surpassing $1,110 USDT with a mere 0.27% 24-hour dip is no accident—it’s ecosystem steel shining through market storms. From algo-induced lows to whale-fueled rebounds, BNB’s story screams undervalued strength, eyeing $1,200 as the next chapter. Traders: Buy above $1,070; HODLers: Stake for yields. In alts’ arena, BNB’s narrowed loss is the bull’s quiet roar.

Our Take: Bullish – Target $1,150, guard $1,070 support.

Your BNB forecast for Q4? Comment below! For more BNB price updates, Binance ecosystem news 2025, or altcoin analysis, stay tuned.