Japan Exchange Group Explores Measures to Curb Crypto-Hoarding Firms Amid Rising Volatility Concerns.

In a move that signals growing regulatory scrutiny over the intersection of traditional finance and digital assets, the Japan Exchange Group (JPX), operator of the Tokyo Stock Exchange, is actively considering steps to rein in the proliferation of listed companies aggressively accumulating cryptocurrencies as treasury reserves.

This development comes at a pivotal moment, as Japan’s corporate embrace of crypto—particularly Bitcoin—has fueled explosive stock gains for some firms but also exposed retail investors to devastating losses tied to the asset class’s notorious volatility. With Bitcoin’s price swinging wildly throughout 2025, from highs above $106,000 in early November to recent dips around $102,000, the JPX’s potential interventions could reshape how Japanese firms integrate digital assets into their balance sheets.

The trend of “digital asset treasury” (DAT) companies, where firms pivot toward holding large crypto portfolios to boost shareholder value, exploded in Japan this year. Inspired by U.S. pioneer MicroStrategy, which holds over 640,000 BTC, Japanese corporations saw an opportunity to leverage Bitcoin’s bull run to transform stagnant businesses. Metaplanet Inc., once a modest hotel operator, emerged as the poster child, amassing over 30,000 BTC and catapulting its shares up 1,700% year-to-date at their peak. However, as crypto prices cooled, Metaplanet’s stock plummeted nearly 78% from its June high of ¥1,930 to around ¥427 by mid-November, wiping out billions in market value and leaving retail investors reeling.

JPX’s concerns center on investor protection and market integrity. Sources familiar with the discussions reveal that the exchange is exploring stricter enforcement of backdoor listing rules—where non-crypto firms acquire or merge with crypto-heavy entities to gain listings—and potentially requiring new audits for DAT hopefuls. Since September, JPX has already pushed back on at least three companies’ plans to initiate crypto purchases, effectively halting their treasury strategies. “The influx of these firms risks undermining the exchange’s reputation,” one insider noted, highlighting fears that unchecked hoarding could amplify systemic risks in a market already strained by yen weakness and global economic uncertainty.

The Rise of Japan Exchange Crypto Treasury Phenomenon

Japan’s foray into corporate crypto hoarding is no accident. The country has long been a crypto hotspot, with retail adoption surging after regulatory easing in 2023 allowed stablecoins and clearer guidelines for exchanges. By July 2025, Japanese investors’ crypto assets topped a record ¥5 trillion ($33 billion), up 25% in a single month. This enthusiasm spilled into corporate boardrooms, where executives eyed Bitcoin not just as a hedge against inflation but as a growth engine. Firms like Metaplanet adopted the “Nakamoto Strategy,” aggressively buying BTC with debt and equity raises, promising “BTC Yield”—a metric tracking per-share Bitcoin growth—to lure investors.

Metaplanet’s journey exemplifies the highs and lows. Starting with just 98 BTC in April 2024, the firm ramped up acquisitions, hitting 30,823 BTC by September 30, 2025, at a total cost of about $414 million and a current value exceeding $3.17 billion. This made it Asia’s largest public Bitcoin holder and the fourth globally, behind giants like MicroStrategy and MARA Holdings. CEO Simon Gerovich touted a Q3 BTC Yield of 33%, with ambitions to reach 210,000 BTC by 2027—1% of total supply. Yet, the strategy’s debt-fueled nature amplified risks; a $100 million Bitcoin-collateralized loan in early November underscored how leverage could exacerbate downturns.

Other firms followed suit. Nexon Co., the gaming behemoth behind hits like MapleStory, holds 1,717 BTC worth $177 million, viewing it as a treasury diversification play. Remixpoint, an energy and fintech player, sits on 1,411 BTC ($145 million), while apparel retailer Anap Holdings and construction firm Convano each boast over 1,000 and 665 BTC, respectively. Japan now hosts 14 listed Bitcoin-holding companies, more than any other Asian nation, per industry trackers. These DATs attracted retail frenzy, with shares often trading at premiums to their net asset value (NAV), betting on crypto’s upside.

But 2025’s volatility turned triumph to tragedy. Bitcoin’s year-to-date average hovers at $103,511, but monthly swings—peaking at $110,544 in late October before sliding—correlated directly with stock carnage. A research paper from August noted crypto fluctuations as a “leading indicator” of Japanese stock volatility, with large BTC drops triggering 10-15% plunges in DAT equities. Globally, 23 of 43 DAT firms lost over half their market cap this year, and Japan’s cohort fared no better. Convano, initially Ethereum-focused but now diversified into BTC, saw shares halve amid ETH’s underperformance.

Risks and Regulatory Red Flags

The JPX’s alarm bells are ringing loud. Retail investors, who dominate Tokyo’s trading volume, poured into DAT stocks chasing “the next MicroStrategy,” only to face margin calls and forced sales during dips. Metaplanet’s market cap briefly surpassed ¥485 billion in June but now languishes below its Bitcoin NAV, a stark reminder of overvaluation risks. Governance concerns loom large too: Are these firms truly transforming, or are they speculative vehicles masking weak core businesses? JPX fears a “DAT rout” could erode trust in the exchange, especially as Asian peers like Hong Kong’s bourse impose free-float limits on crypto-tied listings.

Proposed curbs include:

- Stricter Backdoor Scrutiny: DATs often emerge via reverse mergers, bypassing rigorous IPO vetting. JPX may demand full delisting reviews for such pivots.

- Mandatory Audits: New entrants could face specialized crypto-risk assessments, including stress tests for 50% BTC drawdowns.

- Holding Caps: Informal limits on crypto as a percentage of assets, say 20-30%, to prevent overexposure.

- Disclosure Mandates: Real-time NAV reporting tied to crypto prices, reducing information asymmetry.

These echo global trends. The U.S. SEC has probed MicroStrategy’s accounting, while Singapore’s MAS flagged treasury risks in 2024. In Japan, the Financial Services Agency (FSA) already classifies BTC as “not a currency” but permits holdings; JPX’s moves would layer exchange-specific guardrails.

| Company Name | Ticker | BTC Holdings | Approximate Value (USD, Nov 2025) | Notes |

|---|---|---|---|---|

| Metaplanet Inc. | 3350.T | 30,823 | $3,177,280,449 | Asia’s largest; 78% stock drop from June peak |

| Nexon Co., Ltd. | 3659.T | 1,717 | $176,990,901 | Gaming firm; diversified treasury |

| Remixpoint Inc. | 3825.T | 1,411 | $145,478,718 | Energy/fintech; steady accumulation |

| Anap Holdings Inc. | 3189.T | 1,111 | $114,525,885 | Apparel retailer; recent pivot |

| Convano Inc. | 3490.T | 665 | $68,549,184 | Construction; multi-asset including ETH |

Table 1: Top Japanese Public Companies Holding Bitcoin as Treasury Assets (Data as of November 2025)

Visualizing the Holdings Landscape

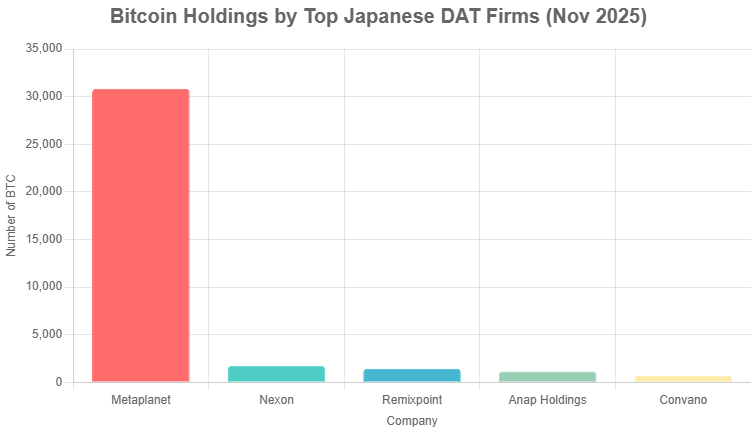

To illustrate the concentration of Bitcoin treasuries among Japan’s top DATs, the following chart depicts the BTC holdings for the leading five firms. Metaplanet’s dominance is evident, holding over 90% of the group’s total, which underscores the skewed risk profile in the sector.

This visualization highlights how a handful of players control the majority of corporate BTC exposure, amplifying JPX’s worries about concentrated vulnerabilities.

Broader Market Implications

If implemented, JPX’s curbs could chill Japan’s DAT boom, prompting firms to pause acquisitions—three already have—and redirect capital to traditional assets. Bullish analysts argue this would foster sustainable growth, weeding out speculative “zombie” companies. Bears warn of stifled innovation, potentially driving talent to less regulated hubs like Dubai. For global markets, Japan’s actions may inspire copycats; with DAT holdings totaling $137 billion worldwide (up 140% YTD), volatility spillovers remain a contagion risk.

Retail investors, who fueled 70% of DAT trading volume, face the sharpest pain. Education campaigns from the FSA emphasize diversification, but losses—estimated at ¥200 billion across Japanese DATs in Q4 alone—have sparked lawsuits against under-disclosing boards. On the flip side, survivors like Metaplanet, with its options-trading arm generating $16 million in Q3 revenue, could emerge stronger, blending crypto yields with prudent risk management.

A Crossroads for Crypto in Corporate Japan

As November 2025 unfolds, JPX’s deliberations mark a crossroads. Will Japan double down on its crypto leadership, balancing innovation with safeguards, or retreat into conservatism? The exchange’s final stance, expected by year-end, could define Asia’s role in the Bitcoin era. For now, firms like Metaplanet soldier on, buying dips and preaching long-termism. “Bitcoin’s volatility is its feature, not a bug,” Gerovich quipped in a recent earnings call. Yet, with shares trading below NAV and regulators circling, the message to hoarders is clear: Proceed with caution—or risk delisting.

In the end, this saga underscores a timeless truth: Crypto’s promise of wealth is matched only by its peril of ruin. As JPX weighs its next move, Japanese investors would do well to heed the lesson—diversify, disclose, and don’t bet the farm on the orange coin.