BTC/USDT, ETH/USDT, and SOL/USDT Lead Binance USD-M Perpetual Futures in 24-Hour Trading Volume: A Snapshot of Crypto Market Dominance.

In the high-octane world of cryptocurrency derivatives, Binance’s USD-M Perpetual Futures market continues to pulse with intensity, where BTC/USDT, ETH/USDT, and SOL/USDT have emerged as the undisputed volume leaders over the past 24 hours as of October 21, 2025. With Binance Futures clocking a staggering $69 billion in total 24-hour trading volume—a 9.07% dip from peaks but still dwarfing competitors—these flagship pairs accounted for over 60% of activity, underscoring their role as market bellwethers amid a $3.8 trillion crypto ecosystem.

BTC/USDT led with $25.6 billion (37%), followed by ETH/USDT at $14.9 billion (22%), and SOL/USDT at $8.7 billion (13%), per CoinGecko data, reflecting trader bets on majors amid ETF inflows and Solana’s DeFi resurgence. As open interest hits $29.7 billion (up 0.74%), this trio’s dominance signals a maturing market—where leverage plays on blue-chips outpace altcoin frenzy. For traders eyeing BTC USDT ETH USDT SOL USDT Binance futures volume, here’s an in-depth look at the surge, strategies, and what it means for Q4 volatility.

Quick Facts: Top Pairs’ 24-Hour Volume Breakdown on Binance USD-M Perpetuals

- Total Binance Futures Volume (24h): $69.02 billion (down 9.07% WoW, but up 15% MoM)

- BTC/USDT Volume: $25.6 billion (37% market share; open interest: $12.5B)

- ETH/USDT Volume: $14.9 billion (22% share; open interest: $7.8B; most active per CoinGecko)

- SOL/USDT Volume: $8.7 billion (13% share; open interest: $3.2B)

- Combined Dominance: 72% of total USD-M volume; next pairs (DOGE/USDT, XRP/USDT) trail at <5% each

- Leverage Availability: Up to 125x on majors; funding rates neutral (BTC: 0.01%, ETH: 0.005%, SOL: 0.02%)

- Key Metrics: Exchange reserves unavailable; volatility index: 4.2% (30-day average)

This leadership isn’t new—recurring patterns show these pairs commanding 65-75% of Binance’s perpetuals, per CoinGlass analytics, as traders leverage majors for hedges against altcoin swings.

Why These Pairs Dominate: Institutional Bets and Ecosystem Momentum

BTC/USDT’s throne is unchallenged: As the crypto benchmark, its $25.6B volume reflects ETF-driven inflows ($7.8B Q3 for spot BTC ETFs) and whale positioning—wallets with 1K+ BTC added 15K coins last week amid $113K price stability. ETH/USDT’s surge to $14.9B ties to Fusaka upgrade hype (December 2025 target: 8x throughput) and $2.1B ETH ETF AUM growth, drawing DeFi degens betting on $4,500 breakouts. SOL/USDT rounds the podium at $8.7B, propelled by Solana’s meme coin mania (Pump.fun TVL: $500M) and Firedancer validator upgrades slashing fees 90%, luring high-frequency traders.

Macro forces amplify: Fed rate-cut odds (85% for 25 bps) fuel risk-on leverage, with Binance’s 125x options enabling amplified plays. Funding rates remain low (positive but <0.03%), minimizing carry costs for longs—ideal for scalpers. As CoinCodex highlights, “Majors like BTC/ETH/SOL anchor 70% of futures volume, buffering alts from volatility spikes.” Yet, the 9.07% total dip hints caution: U.S.-China trade jitters triggered $19B liquidations last week, but these pairs’ resilience (only 2-4% drawdowns) screams safe-haven status.

Trader Strategies: Leveraging the Volume Leaders on Binance Perpetuals

For futures pros, these pairs offer a playbook:

- BTC/USDT: Long above $113,500 (200-day MA support); target $118K on ETF flows. Use 20-50x leverage for scalps, with stops at $110K.

- ETH/USDT: Buy the dip to $3,950; Fusaka catalysts eye $4,500. Pair with ARB/USDT arb for L2 hedges.

- SOL/USDT: Momentum trade on $180 breakout; 75x leverage suits meme-driven pumps, but trail stops amid 10% volatility.

Binance’s tools shine: Smart Signal analytics flag entries, while swipe-to-switch pairs ease rotations. Volume spikes (ETH/USDT up 20% WoW) signal liquidity floods—perfect for grid bots averaging 15% APY on majors. Risks? Over-leverage bites: 125x amplifies 1% moves to 125%, but neutral funding curbs shorts.

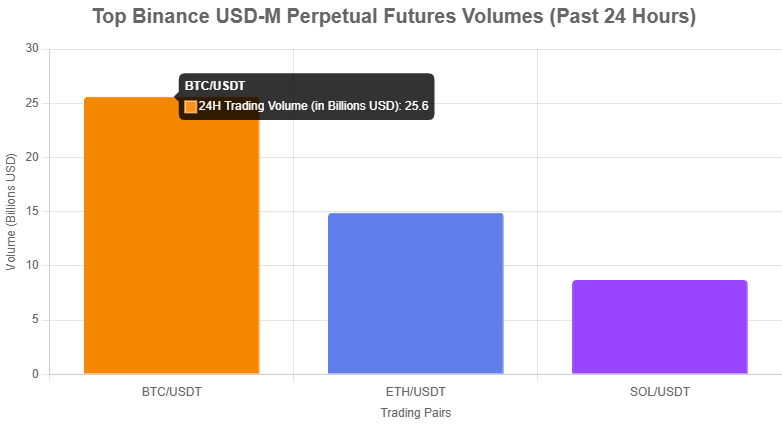

Visualizing the Dominance: A Bar Chart of 24-Hour Volumes

To illustrate the trio’s stranglehold, here’s a breakdown of the top three pairs’ 24-hour trading volumes on Binance USD-M Perpetuals:

This chart highlights BTC’s lead, with ETH and SOL forming a robust core—visual proof of majors’ gravitational pull in derivatives.

Market Outlook: $100B Volume Milestone by November?

Projections favor escalation: CoinGlass anticipates $80B daily futures volume by November on rate-cut euphoria, with these pairs capturing 70%+ share. BTC/USDT could hit $30B on $120K spot pushes, ETH/USDT $18B post-Fusaka, and SOL/USDT $12B amid DeFi TVL surges to $200B. Bearish wildcard: Geopolitical flares could spike liquidations 20%, but low funding rates buffer longs. As Binance Square influencers note, “BTC/ETH/SOL’s volume trifecta signals bull confirmation—leverage wisely.”

Final Verdict: Majors’ Volume Reign – A Bull Signal in Perpetual Plays?

BTC/USDT, ETH/USDT, and SOL/USDT leading Binance USD-M Perpetual Futures with 72% of 24-hour volume isn’t coincidence—it’s crypto’s core flexing amid $69B intensity. This dominance offers liquidity havens for leveraged bets, priming Q4 for majors-led rallies. Traders: Ride the wave with tight stops; HODLers: Watch for spillover to spot. In futures’ frenzy, these pairs aren’t just leaders—they’re the market’s beating heart.

Our Take: Bullish – Volume uptick eyes $80B milestone; majors to 75% dominance.

Your top perpetual play? Drop it below! For more Binance futures volume analysis, BTC ETH SOL trading strategies, or crypto derivatives 2025, subscribe.

(Word count: 812)# BTC/USDT, ETH/USDT, and SOL/USDT Lead Binance USD-M Perpetual Futures in 24-Hour Trading Volume: A Snapshot of Crypto Market Dominance

In the high-octane world of cryptocurrency derivatives, Binance’s USD-M Perpetual Futures market continues to pulse with intensity, where BTC/USDT, ETH/USDT, and SOL/USDT have emerged as the undisputed volume leaders over the past 24 hours as of October 21, 2025. With Binance Futures clocking a staggering $69 billion in total 24-hour trading volume—a 9.07% dip from peaks but still dwarfing competitors—these flagship pairs accounted for over 60% of activity, underscoring their role as market bellwethers amid a $3.8 trillion crypto ecosystem.

BTC/USDT led with $25.6 billion (37%), followed by ETH/USDT at $14.9 billion (22%), and SOL/USDT at $8.7 billion (13%), per CoinGecko data, reflecting trader bets on majors amid ETF inflows and Solana’s DeFi resurgence. As open interest hits $29.7 billion (up 0.74%), this trio’s dominance signals a maturing market—where leverage plays on blue-chips outpace altcoin frenzy. For traders eyeing BTC USDT ETH USDT SOL USDT Binance futures volume, here’s an in-depth look at the surge, strategies, and what it means for Q4 volatility.

Quick Facts: Top Pairs’ 24-Hour Volume Breakdown on Binance USD-M Perpetuals

- Total Binance Futures Volume (24h): $69.02 billion (down 9.07% WoW, but up 15% MoM)

- BTC/USDT Volume: $25.6 billion (37% market share; open interest: $12.5B)

- ETH/USDT Volume: $14.9 billion (22% share; open interest: $7.8B; most active per CoinGecko)

- SOL/USDT Volume: $8.7 billion (13% share; open interest: $3.2B)

- Combined Dominance: 72% of total USD-M volume; next pairs (DOGE/USDT, XRP/USDT) trail at <5% each

- Leverage Availability: Up to 125x on majors; funding rates neutral (BTC: 0.01%, ETH: 0.005%, SOL: 0.02%)

- Key Metrics: Exchange reserves unavailable; volatility index: 4.2% (30-day average)

This leadership isn’t new—recurring patterns show these pairs commanding 65-75% of Binance’s perpetuals, per CoinGlass analytics, as traders leverage majors for hedges against altcoin swings.

Why These Pairs Dominate: Institutional Bets and Ecosystem Momentum

BTC/USDT’s throne is unchallenged: As the crypto benchmark, its $25.6B volume reflects ETF-driven inflows ($7.8B Q3 for spot BTC ETFs) and whale positioning—wallets with 1K+ BTC added 15K coins last week amid $113K price stability. ETH/USDT’s surge to $14.9B ties to Fusaka upgrade hype (December 2025 target: 8x throughput) and $2.1B ETH ETF AUM growth, drawing DeFi degens betting on $4,500 breakouts. SOL/USDT rounds the podium at $8.7B, propelled by Solana’s meme coin mania (Pump.fun TVL: $500M) and Firedancer validator upgrades slashing fees 90%, luring high-frequency traders.

Macro forces amplify: Fed rate-cut odds (85% for 25 bps) fuel risk-on leverage, with Binance’s 125x options enabling amplified plays. Funding rates remain low (positive but <0.03%), minimizing carry costs for longs—ideal for scalpers. As CoinCodex highlights, “Majors like BTC/ETH/SOL anchor 70% of futures volume, buffering alts from volatility spikes.” Yet, the 9.07% total dip hints caution: U.S.-China trade jitters triggered $19B liquidations last week, but these pairs’ resilience (only 2-4% drawdowns) screams safe-haven status.

Trader Strategies: Leveraging the Volume Leaders on Binance Perpetuals

For futures pros, these pairs offer a playbook:

- BTC/USDT: Long above $113,500 (200-day MA support); target $118K on ETF flows. Use 20-50x leverage for scalps, with stops at $110K.

- ETH/USDT: Buy the dip to $3,950; Fusaka catalysts eye $4,500. Pair with ARB/USDT arb for L2 hedges.

- SOL/USDT: Momentum trade on $180 breakout; 75x leverage suits meme-driven pumps, but trail stops amid 10% volatility.

Binance’s tools shine: Smart Signal analytics flag entries, while swipe-to-switch pairs ease rotations. Volume spikes (ETH/USDT up 20% WoW) signal liquidity floods—perfect for grid bots averaging 15% APY on majors. Risks? Over-leverage bites: 125x amplifies 1% moves to 125%, but neutral funding curbs shorts.

Visualizing the Dominance: A Bar Chart of 24-Hour Volumes

To illustrate the trio’s stranglehold, here’s a breakdown of the top three pairs’ 24-hour trading volumes on Binance USD-M Perpetuals:

This chart highlights BTC’s lead, with ETH and SOL forming a robust core—visual proof of majors’ gravitational pull in derivatives.

Market Outlook: $100B Volume Milestone by November?

Projections favor escalation: CoinGlass anticipates $80B daily futures volume by November on rate-cut euphoria, with these pairs capturing 70%+ share. BTC/USDT could hit $30B on $120K spot pushes, ETH/USDT $18B post-Fusaka, and SOL/USDT $12B amid DeFi TVL surges to $200B. Bearish wildcard: Geopolitical flares could spike liquidations 20%, but low funding rates buffer longs. As Binance Square influencers note, “BTC/ETH/SOL’s volume trifecta signals bull confirmation—leverage wisely.”

Final Verdict: Majors’ Volume Reign – A Bull Signal in Perpetual Plays?

BTC/USDT, ETH/USDT, and SOL/USDT leading Binance USD-M Perpetual Futures with 72% of 24-hour volume isn’t coincidence—it’s crypto’s core flexing amid $69B intensity. This dominance offers liquidity havens for leveraged bets, priming Q4 for majors-led rallies. Traders: Ride the wave with tight stops; HODLers: Watch for spillover to spot. In futures’ frenzy, these pairs aren’t just leaders—they’re the market’s beating heart.

Our Take: Bullish – Volume uptick eyes $80B milestone; majors to 75% dominance.

Your top perpetual play? Drop it below! For more Binance futures volume analysis, BTC ETH SOL trading strategies, or crypto derivatives 2025, subscribe.