A Sharp Pullback for Hedera: HBAR Dives Amid Broader Altcoin Weakness

Hedera Hashgraph’s native token HBAR has taken a severe hit, plunging 11.5% in the past 24 hours to approximately $0.134 as of November 21, 2025—the lowest level in over a month and a clear break below critical support zones. This crash, which wiped out nearly $500 million in market cap (now ~$5.7 billion), comes amid a broader altcoin rout, with the total crypto market down 6% today to $3.23 trillion and Bitcoin testing $96,000.

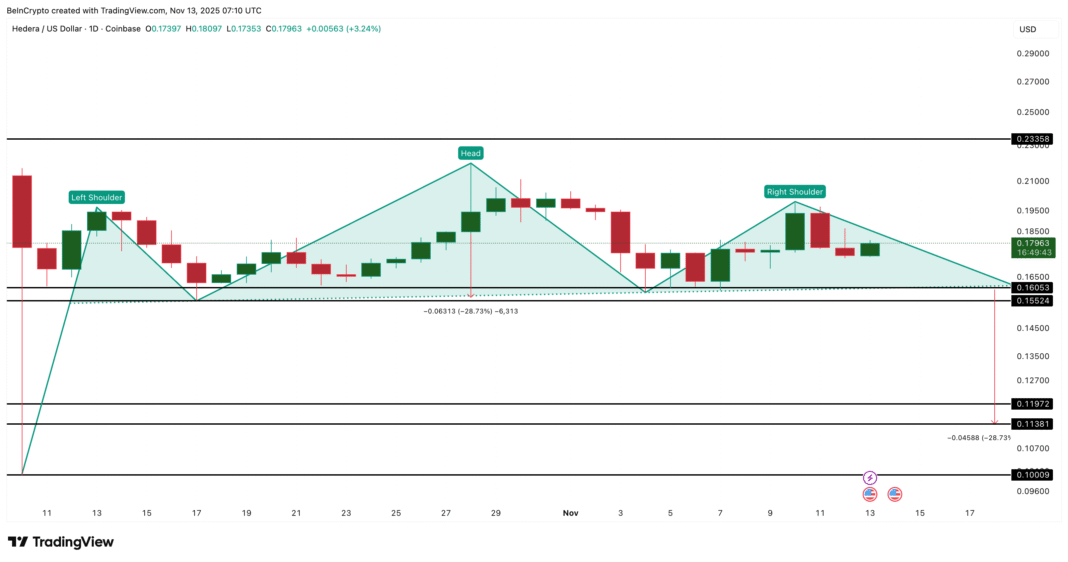

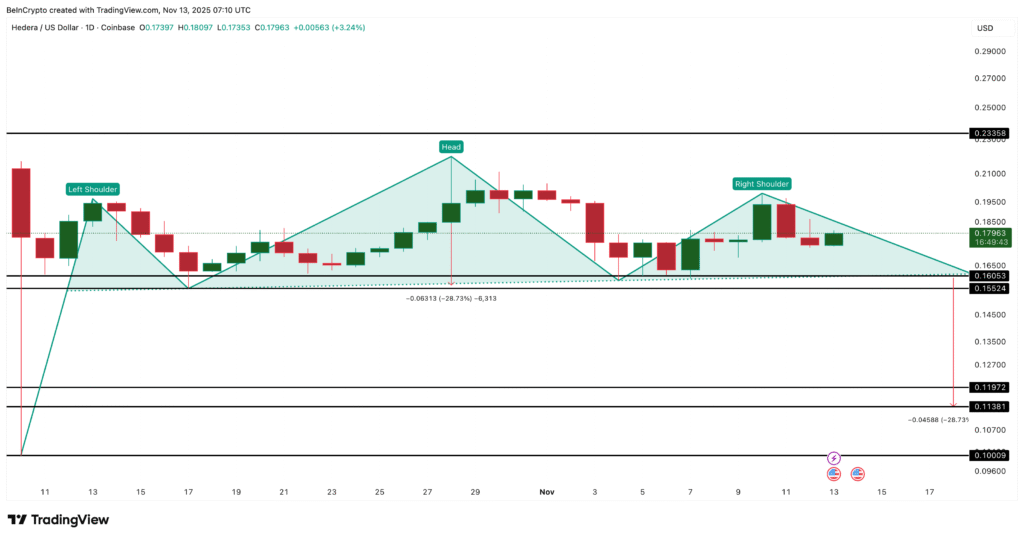

HBAR’s decline—underperforming the market by 5.5 percentage points—has shattered key technical floors like the $0.145 double-bottom and descending OBV trendline, triggering bearish signals including a death cross and heavy short positioning (475% more shorts than longs). With RSI at oversold levels and volume spiking 180% above average during the drop, the question looms: Is this capitulation setting up a bounce, or the prelude to $0.10 lows (30% further downside)?

The plunge isn’t isolated: HBAR has shed nearly 50% over the past three months, from August highs near $0.26, amid fading DeFi momentum (TVL stagnant at ~$100 million) and competition from faster chains like Solana (32% DeFi share vs. Hedera’s declining slice). Yet, on-chain resilience—active addresses holding steady and no major whale dumps—hints at absorption, with analysts like those at BeInCrypto spotting bullish divergences (higher RSI lows amid price lower lows) that could spark a short squeeze.

In a market where stablecoin volumes hit $19.4 billion YTD and institutions absorb 300K BTC, HBAR’s crash tests Hedera’s enterprise focus (e.g., Wrapped Bitcoin integration and subnet growth)—a dip to buy or a trend to flee? This analysis unpacks the breakdown, catalysts, and 2025 outlook.

The Crash Breakdown: Key Supports Shattered

HBAR’s 11.5% nosedive—worst single-day drop since October—breached multiple layers:

- $0.145 Double-Bottom: Former support turned resistance; break confirms bearish continuation.

- Descending OBV Trendline: On-balance volume lower lows despite price higher lows signal distribution.

- $0.1382 Intraday Low: V-shaped rebound failed, with $0.134 now immediate floor.

Volume exploded 180% above average (168.9 million tokens traded late November 16), with shorts dominating (475% imbalance, $15.32 million shorts vs. $2.66 million longs). Liquidation map shows $0.144 break could squeeze shorts, but $0.129 loss opens $0.10 (October low, 25% down).

| Level | Type | Status | Next Target if Broken |

|---|---|---|---|

| $0.145 | Former Support | Broken | $0.138 (Intraday Low) |

| $0.138 | Immediate Support | Tested | $0.129 (30% Downside Risk) |

| $0.129 | Major Support | At Risk | $0.10 (October Low) |

| $0.144 | Resistance | Reclaim Needed | $0.148 (Short-Term Relief) |

Why the Crash? Weak Demand and Bearish Signals

HBAR’s plunge stems from fading momentum:

- Chaikin Money Flow (CMF): Three-month low at -0.09, signaling sustained outflows.

- MACD Bearish Crossover: Shrinking histogram confirms downside until bullish flip.

- Short Dominance: 475% more shorts than longs ($15.32M vs. $2.66M liquidation risk) reflect no bounce expectation.

- Broader Alt Fatigue: Crypto market down 6%; HBAR underperforms majors (BTC -1.23%, ETH flat).

Yet, bullish hints emerge: RSI divergence (higher lows amid price lower lows) and CMF curling up since November 3 suggest dip-buying. On-chain: No major whale dumps; inflows building against short-term selling.

Outlook: Short Squeeze or Deeper Pain?

Analysts split: BeInCrypto’s Harsh Notariya sees “short squeeze potential” if $0.144 reclaims (volume needed), targeting $0.148-$0.20. CoinGape warns 30% dive to $0.10 on death cross confirmation. Consensus: $0.13-$0.15 range short-term; $0.20+ on squeeze.

| Scenario | Probability | Price Target | Timeline |

|---|---|---|---|

| Short Squeeze Rebound | 55% | $0.148-$0.20 | 1-2 Weeks |

| Breakdown Continuation | 45% | $0.129-$0.10 | Next Week |

In a $3.23T market, HBAR’s crash is pain—but oversold signals whisper opportunity. Hold $0.138 for bounce; break risks $0.10. DYOR; volatility reigns.