A Crypto Rebound Masterclass: Dunamu’s Explosive Quarter

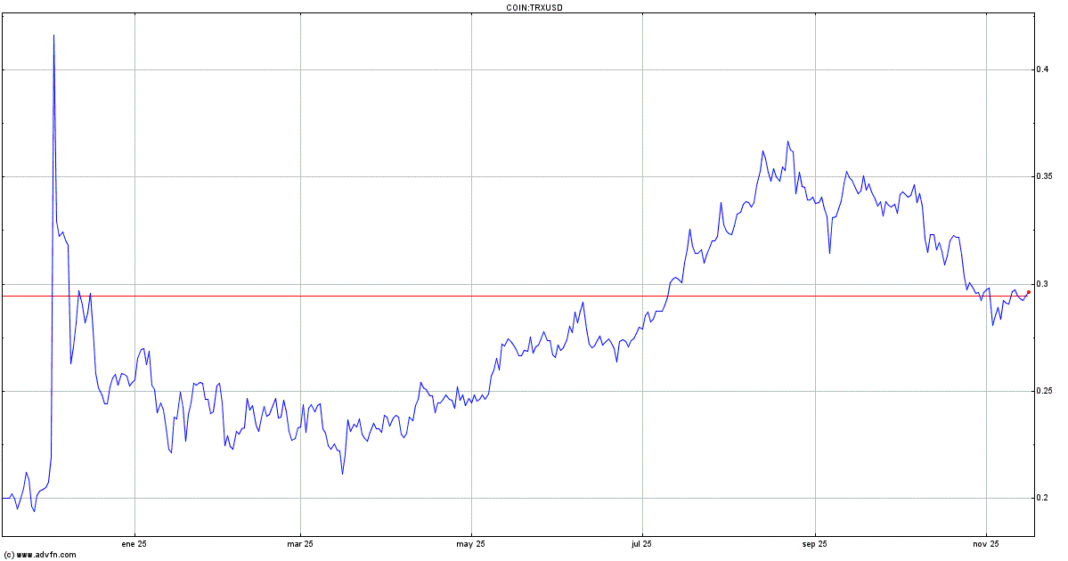

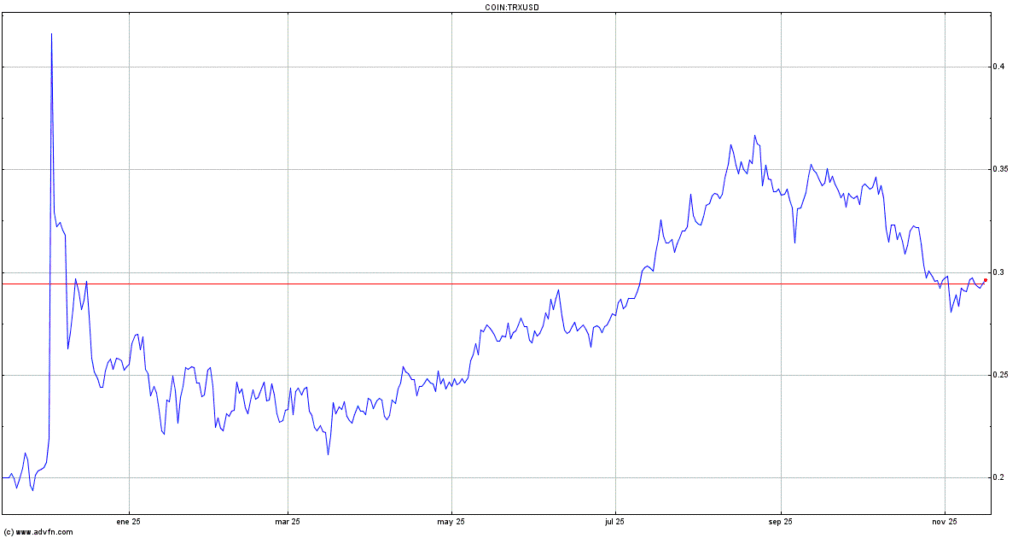

South Korea’s cryptocurrency powerhouse, Dunamu Inc.—the parent company behind the nation’s largest exchange, Upbit—has delivered a blockbuster Q3 2025 performance, reporting a net profit of $165 million (239 billion won), a staggering 300% surge from the $40 million posted in the same period last year. This record-breaking result, announced on November 16, 2025, via regulatory filings with the Financial Supervisory Service, reflects the broader digital asset market’s rebound and heightened investor sentiment fueled by U.S. regulatory clarity, such as the GENIUS Act and Clarity Act. Revenue climbed 108% year-over-year to $265 million (385.9 billion won), while operating profit nearly tripled to $161 million (235.3 billion won), underscoring Dunamu’s operational resilience in a volatile sector.

Upbit, which commands a dominant 71.6% share of South Korea’s $895 billion first-half 2025 trading volume, benefited from a 145% quarter-over-quarter net income jump, driven by stabilized asset prices and institutional inflows. The exchange processed $286.4 billion in Q3 volumes, nearly double the prior year, as global markets recovered and U.S. legislation boosted confidence among Korean investors. In a market where exchanges like Binance and Coinbase face global scrutiny, Dunamu’s results—coupled with a tripled dividend payout of 8,777 won ($5.99) per share, totaling $205 million—affirm Upbit’s unchallenged supremacy in Asia’s most crypto-savvy nation.

Financial Breakdown: From Revenue Boom to Profit Powerhouse

Dunamu’s Q3 metrics paint a picture of explosive efficiency, transforming market tailwinds into bottom-line dominance. Net profit’s 300% leap outpaced revenue’s 108% growth, highlighting cost controls and diversified streams beyond trading fees, including staking and NFT platforms.

| Metric | Q3 2025 Value | YoY Change | QoQ Change | Key Driver |

|---|---|---|---|---|

| Net Profit | $165M (239B KRW) | +300% | +145% | Market rebound, U.S. regs boosting volumes |

| Revenue | $265M (385.9B KRW) | +108% | N/A | Upbit’s $286.4B Q3 volume (2x YoY) |

| Operating Profit | $161M (235.3B KRW) | +180.3% | N/A | Fee revenue from BTC/ETH trades |

| Dividend per Share | $5.99 (8,777 KRW) | +3x | N/A | Total payout $205M (300B KRW) |

These figures eclipse rivals: Bithumb’s Q3 revenue hit $135.2 million (196B KRW, +184.4% YoY), but operating profit of $48.3 million (70.1B KRW) paled against Dunamu’s, capturing just 25.8% market share. Dunamu’s 9.67 million users (up 52% YoY) and 105.1 trillion won in holdings further solidify Upbit’s moat.

Catalysts Behind the Surge: Market Recovery and Regulatory Wins

Dunamu credited Q3’s boom to a “rebound in global digital asset markets” and “improved regulations and systems boosting confidence.” U.S. milestones like the GENIUS Act and Clarity Act eased global sentiment, driving Korean inflows into BTC and ETH—Upbit’s top pairs. Domestically, the Financial Supervisory Service’s March 2025 injunction against FIU restrictions preserved user onboarding, countering antitrust fears over Upbit’s 71.6% dominance.

Diversification shines: Platforms like Securities Plus and NFT marketplaces added buffers, while international pushes—Upbit Singapore’s 25-100 staff expansion—eye Southeast Asia. Salaries averaging 116 million won ($79K) annually attract talent, fueling innovation.

Challenges Ahead: Monopoly Scrutiny and Global Expansion

Upbit’s 72% share invites regulatory heat: Bithumb warned of “extinction” risks, and the FIU’s AML probes could tighten KYC. A March 2025 court win shielded growth, but antitrust looms. Globally, Naver Financial’s rumored acquisition via share swap could reshape dynamics, pending board approval.

For 2026, Dunamu projects double-digit profits, with generous dividends amid $1.3 billion YTD revenue. As South Korea’s 10 million crypto users swell, Upbit’s trajectory—mirroring Binance’s ascent—affirms its throne. In a year of ETF highs ($70B AUM) and stablecoin surges ($19.4B YTD), Dunamu’s 300% leap isn’t anomaly—it’s ascent. Shareholders reap; the market hungers for more.